Click here to subscribe today or Login.

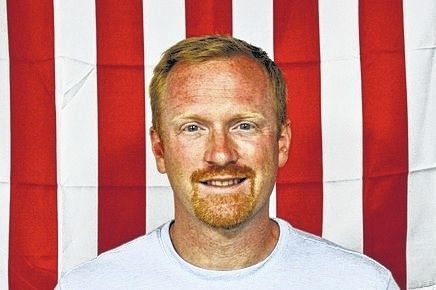

Luzerne County Councilman Harry Haas said it’s time tax-exempt colleges and universities start paying something for county services to relieve the burden on other property owners.

As he and his colleagues debated 2017 budget options last week, Haas said he respects the institutions he wants to start paying — King’s College and Wilkes University in Wilkes-Barre and Misericordia University in Dallas Township — and believes they bring value to the county.

“I acknowledge all of that, but at the same time I think it’s just a matter of equity for those folks out there to have to pay for the same services,” Haas said, citing county 911, criminal justice and emergency management as examples.

Haas proposed budgeting $225,000 in revenue from the three institutions next year, or $75,000 each. He later withdrew the motion due to concerns raised about counting on receipts that can’t be guaranteed.

County Chief Solicitor Romilda Crocamo told the council the payments in lieu of taxes, called “PILOTs” for short in government, are voluntary and not legally mandated. The county would need to negotiate an intergovernmental agreement with each institution to ensure payment, she said.

County Manager C. David Pedri told the council he agrees with Haas and spoke with both Wilkes-Barre institutions urging them to pay something. He has not met with Misericordia to discuss the issue. County officials did not include Penn State or Luzerne County Community College in the mix because they are government affiliated.

Another option Pedri is considering: college and university handling of services to save the county money or enhance offerings, such as conservation programs at the River Common along the Susquehanna River. Pedri said he plans to present alternatives to the council next year.

Representatives of all three institutions said they are receptive to discussions.

John Loyack, executive vice president of business and administrative affairs at King’s, said college representatives have been working with Pedri for months and hope to reach a proposed agreement this spring.

“We are in conversations with Dave to find a good solution to help support the county,” Loyack said.

Loyack said building enhancements at King’s have helped boost the value of other downtown Wilkes-Barre properties, which helps increase property tax revenue. College students also strengthen the local economy by renting apartments and patronizing businesses, he said.

Misericordia President Thomas J. Botzman said his institution appreciates and values its relationship with governments at all levels.

“We eagerly support joint initiatives, collaborate on grant funding, and engage our elected officials to discuss areas where our university’s resources can be of assistance,” Botzman said. “We provide positive inputs to the local economy and tax base by attracting thousands of students and visitors each year as well as creating jobs for hundreds of talented people.”

Tax-exempt status is “extremely important” to allow colleges and universities to “remain viable, serve the public good, and provide affordable education to our students,” he said.

“We would respectfully review any request for a payment in lieu of tax made by a government entity to determine the circumstance and context for such a request; however, we believe that our tax-exempt status is critical to our organization, and we cannot guarantee that such payments could be or should be made,” Botzman said.

Mike Wood, special assistant to the president at Wilkes University, said the university was not aware the matter would be discussed in county budget deliberations.

“While we have not made any commitments to make voluntary payments, we remain open to discussions with county officials on ways we can work together to improve our community,” Wood said.

Before withdrawing his motion, Haas said it’s “only fair” the county receive a payment because the institutions compensate municipalities.

King’s is paying Wilkes-Barre $72,500 in lieu of taxes this year, while Wilkes is providing $63,916 to the city, the city budget shows. Their city contributions are projected to rise to $100,000 each next year, the city’s proposed budget says.

Misericordia paid Dallas $4,206.02 in 2016 in lieu of taxes for six properties in the borough, said university Public Relations and Publications Manager Paul Krzywicki.

County officials have acknowledged municipalities may have more success obtaining payments because they provide more tangible services, such as police and fire protection.

Payments to the county also should be at the forefront because they were recommended in the county’s five-year financial recovery plan prepared by Harrisburg-based Public Financial Management, Haas maintained. The company estimated the county could increase revenue $500,000 over five years by phasing in payments equal to 10 percent of current tax rates from the top tax-exempt colleges and medical-related facilities.

Councilman Stephen A. Urban said the county should more aggressively review tax-exempt entities to determine if they still qualify to remain off the tax rolls and urged legislators to revamp the laws on exemption.

Exemption for nonprofits dates back to a time when most of these entities were run by volunteers, but many now have “highly paid” staff, Urban asserted.

Haas said he will discuss the matter at a legislative meeting planned next month and asked the administration to review the taxation of for-profit eateries and other businesses operating within some tax-exempt properties.

A council majority voted to increase county taxes 4 percent in 2017.

“We’re in a critical situation here,” said Haas, who was among the five council members voting against the tax hike.

Pedri said Friday he will work with the three institutions and others to obtain payments or other arrangements.