Click here to subscribe today or Login.

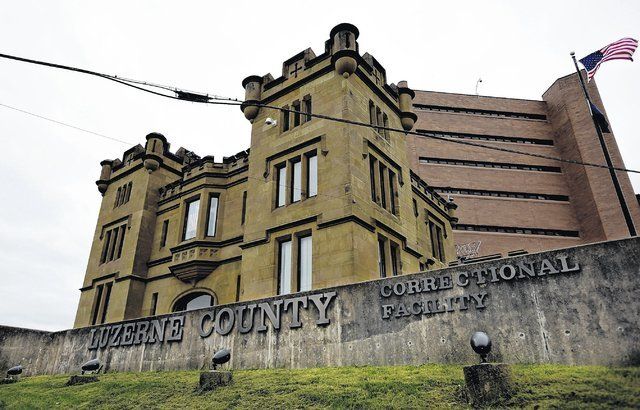

Counterfeit money was brought into the Luzerne County prison three times in 2015, according to a newly released county controller’s office audit.

The counterfeit deposits involved inmate accounts, or money belonging to individual inmates that can be saved or used to buy snacks or other goods from the prison commissary during incarceration, according to the audit and county officials.

There are two ways cash from the street ends up in these accounts — when inmates are carrying the money at the time they are booked and when relatives or friends feed the money into a kiosk in the prison lobby, officials said.

It’s most likely the counterfeit cash came in at booking because the kiosks are “very sophisticated” and typically detect and reject counterfeit bills, county Controller Michelle Bednar said Thursday.

The controller’s office identified and verified with the bank three instances of counterfeit deposits over the year totaling $305 — one for $200, the other for $100 and the third for $5, she said.

The cases were uncovered when controller’s office representatives tried to figure out why bank deposits didn’t match receipts, the audit said.

The audit recommends workers alert the county correctional services division head whenever the bank informs the facility a deposit included counterfeit currency. With prompt notification, the division head can pursue action for the attempted illegal act and ensure the account for the inmate involved in the counterfeit funds is reduced, the audit said.

Without a mechanism to record counterfeit transactions in financial records, the books will reflect a shortfall and open the door to the possibility that funds could be “misappropriated and written off as counterfeit currency,” the audit says.

In an audit reply, Mark Rockovich said he has implemented additional procedures for handling counterfeit funds since he was appointed correctional services division head in July.

A bookkeeper and clerk must obtain written bank confirmation of a counterfeit deposit, reduce the appropriate accounts to show the loss and inform both the division head and deputy warden, Rockovich said.

Bednar said inmate account deposits are being processed in individual “batches,” making it easier for counterfeit money to be traced back to specific inmates.

Former county controller Walter Griffith sent an email to county council members about the audit this week, complaining it lacked some details and questioning why it contains no indication anyone reported the counterfeit funds to law enforcement agencies. A federal crime was committed at the prison, he noted in capital letters.

In response, Bednar said the bank had notified the U.S. Secret Service and turned over the counterfeit bills to that agency. It’s unclear whether any charges have been or will be pursued.

“Just because no emphasis was included in our audit report about notifying law enforcement doesn’t mean the proper authorities weren’t notified by the appropriate people,” Bednar said.

Rockovich said he also set up new protocol to add more checks and balances on the depositing and receipt of money to address audit concerns and is implementing a new software system that will improve the reconciliation of inmate accounts.

“I made a lot of changes to prevent any negligence,” Rockovich said.