Click here to subscribe today or Login.

A proposed increase in money for a state scholarship tax credit program would be the equivalent of denying $1.5 million more to Luzerne County public school districts, an advocacy group critical of the tax credit program contends.

The state house of representative approved a budget earlier this year that increases the amount of tax credits available to two programs: The Educational Improvement Tax Credit and the Opportunity Scholarship Tax Credit.

In both programs, businesses donate money to state-approved organizations which, in turn, use the money for tuition assistance at private schools. The businesses get tax credits based on the amount they give.

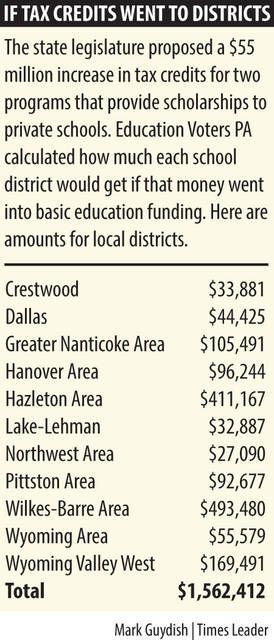

Contending the proposal would mean that $55 million in tax credits “will be dedicated to providing vouchers for private/religious schools,” Education Voters of Pennsylvania calculated how much each district in the state would receive if that $55 million were instead added to the state Basic Education Fund and distributed using the education funding formula adopted last year.

Based on those calculations, converting the tax credits into direct funding to school districts would mean $1.56 million more from the state to Luzerne County’s 11 school districts. The amounts range from $27,090 more for Northwest Area — the county’s smallest district by enrollment — to $493,480 for Wilkes-Barre Area.

Education Voters argues that the Pennsylvania budget is so austere it has been running deficits, and that in such a situation diverting money to private schools through tax credits means cutting spending either in public education or other state programs.

Supporters of the tax credit programs insist they help children from low-income families go to the school of their choice. They also regularly argue that school choice creates competition that should improve all schools, public and private, though tax credit critics point out the private schools are not held to the accountability standards of public schools.

For other local news stories, click here.